Are you thinking of selling your home?

A House Sale Calculator will help you calculate the value of your property and how much it would be sold for in the open market.

They are completely free and easy to use.

And they will do the calculations for you!

Begin by entering your home’s address into the House Sale Calculator.

Then the calculator will retrieve the sold market data from public records, which enables it to generate a report

The House Selling Calculator is a very easy application to use, just enter the appropriate information and it will do the calculations for you!

It has been designed with simplicity in mind; it has a clean, elegant design that will allow you to navigate your way around it with ease.

Here Is An Example Entry Format of A House Sale Calculator

Example:

House Sale Price: $300,000

Mortgage Payoff Amount: $0

The amount is still owed on your mortgage. This will be deducted from your net sale amount.

Real Estate Agent Commission 6%

$ 18,000

In a traditional sale, the seller pays fees to both their agent and the buyer’s agent. The total commission is usually around 6% of the sale price.

Staging and Prep Work 1%

$ 3,000

This is the total cost of getting your home ready to show to potential buyers. It may include a professional stager, cosmetic improvements, or storage.

Seller Concessions 2%

$ 6,000

Seller concessions are closing costs the seller agrees to pay and can help the seller close the deal. These can range from 1.5% to 2% of the sale price.

Home Ownership and Overlap Cost 1%

$ 3,000

These are costs when transitioning from one home to the next. This could be paying for a short-term rental or paying two mortgage payments.

Title, Escrow, Notary, and Transfer Tax 1%

$ 3,000

These are also called closing costs and they can range from 1% to 3% of the sale price depending on where you live.

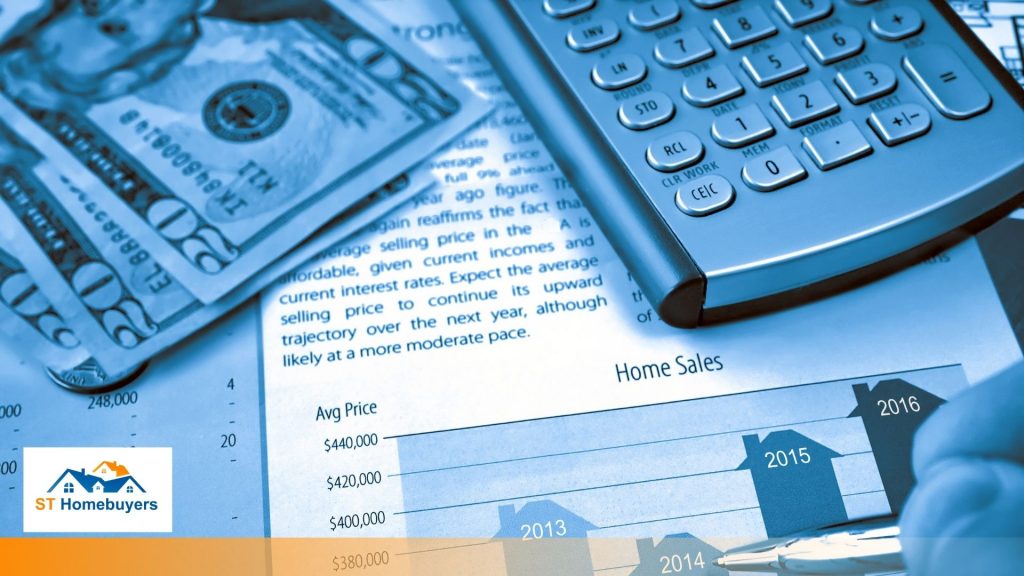

Home Sale Price?

House Sale Calculator will help you determine how much of a profit or loss you will make between buying and selling your home.

This is not an exact science and House Sale Calculator will reflect this.

House Sale Calculator can only provide you with a rough guide to your home’s value and how much it would be sold for in the open market, but House Sale Calculator can certainly help you understand what you might expect from a home sale.

Calculating whether or not to sell your home can be an emotional experience.

House Sale Calculator will help you work out the variables that affect your decision.

The Calculator can provide insight into how each of these factors ( Property Type, Location, House Condition, and House Size ) will influence your final price, in addition to whether or not you will make a profit or loss on the sale of your home.

House Sale Calculators will give you a good idea of the real estate market in your area, so you can make an informed decision on whether or not to sell your house.

What Are Net Proceeds in Real Estate?

Net proceeds refer to the money that remains after all expenses are deducted after a house sale and given to the seller.

These costs include legal and appraisal fees, commissions, taxes, regulatory expenses, and advertising, which may account for a percentage of the gross proceeds.

How Do You Calculate Home Sale Net Proceeds?

It may appear to be more difficult than it is.

It’s not as tough as you think to calculate net proceeds.

Subtract the final purchase price of your property from the overall selling price.

Your net proceeds will be the answer.

Step 1: Add up all of the expenses associated with selling your homes, such as taxes and any required.

What Are Closing Costs?

Closing costs are the minor expenditures that homebuyers must pay when obtaining or closing a new mortgage and deed on a house.

The two most typical situations for closing charges are purchasing a new house and refinancing your liabilities.

Closing costs normally include fees for title, lender, property, and insurance.

Lenders are required by law to provide borrowers with an estimate of closing costs, which is itemized in a loan estimate document or closing disclosure.

While you have the option to pay each charge separately, most consumers choose to pay them as a single lump sum into an escrow account.

The escrow agent may then distribute the correct amounts to each participant

How to Calculate Closing Costs

Closing costs are influenced by a variety of things, including the house’s closing price, your credit score, the size of your down payment, the real estate location, and your mortgage lender.

Closing costs in the United States can range from $2,000 to more than $13,000.

Most lenders advise you to budget your closing costs between one percent and five percent of the home purchase price.

If you’re buying a property for $300,000, your total closing costs might range from $3,000 to $15,000.

You may also use an online closing cost calculator to get a more accurate figure based on your region.

What happens to equity when you sell your house?

When you sell your house, the buyer’s cash covers your mortgage payment as well as transaction expenses.

The remainder of the money goes towards your profit. It might be used for anything, but many purchasers use it to fund a down payment on their new property.

Here’s how the funds are divided up.

- Your mortgage lender gets your loan back.

- Any additional loans (like a HELOC or home equity loan) are paid off.

- The transaction is completed and all costs are paid, including closing fees (including agent commission, taxes, escrow fees, and prorated HOA expenses).

- The remaining profits are passed on to you, the seller.

If your home hasn’t fallen in value since you purchased it and is worth more than the amount owed on it, there should be a profit at resale.

Some of your equity will always have to go toward a transaction and closing costs when calculating profits.

Closing Costs

Closing costs include many smaller fees. Here are some common examples:

- Home inspection fee: The cost of a home inspection is the fee for having an accredited professional examine the property for issues (often $300 to $500).

- Homeowners insurance: Homeowners insurance is a standard fee that homeowners pay to protect their homes from incidents like damage or theft. During closing, a homebuyer often pays up to a year’s worth of homeowners insurance premiums (usually between $400 and $1,000).

- Loan application fee: The loan application fee is the cost of applying for a new loan, as well as credit report costs.

- Loan origination fee: The origination fee, sometimes known as the underwriting cost or processing charge, is the fee paid to have your lender prepare and process your mortgage loan. Some lenders may not charge for originating and instead include it into the interest rate through a higher interest rate. This is one of the most common closing costs, ranging from 0.5 to 1 percent.

- Mortgage broker fee: The mortgage broker fee is the cost of having a mortgage broker help you find and secure a mortgage loan (usually between 0.5 percent to 2.75 percent of the home loan).

- Mortgage insurance application fee: A private mortgage insurance policy (PMI) must be obtained if the homebuyer makes a down payment of less than 20% of the property’s value. The insurance policy application fee is included in the closing costs (usually between $150 and $500).

- Title fees: title fees are the expenses involved in obtaining a house title. A title search, title insurance, recording costs, and transfer taxes might all be charged by a title company to ensure that the seller has legal ownership of the property (typically between $200 and $2,000).

- Appraisal fee: An appraisal fee is a charge levied by a certified professional appraiser to determine the property’s market value (usually between $300 and $400).

- Attorney fees: The attorney fees required by some jurisdictions are known as legal expenses. This fee varies depending on the attorney.

- Discount points: A discount is a fee that some homebuyers pay to lower their mortgage interest rate by, for example, one percent (usually about one percent of the property value).

- Escrow fees: The costs of an escrow account include the third-party escrow company’s charges (typically between $300 and $1,000). The firm will assign a real estate agent to manage your account and make sure that funds are disbursed on schedule.

- Federal loan fees: If you borrow money from a federal loan program, such as Veterans Affairs, the Federal Housing Administration, or the US Department of Agriculture and your down payment is less than 20%, you’ll have to pay a special mortgage insurance fee or guarantee as a type of default protection. These premiums or guarantees referred to as VA, FHA, or USDA loan

- HOA fees: HOA fees are monthly charges that condo owners and homeowners pay in neighborhoods governed by homeowner associations, which guarantee that property owners adhere to ground rules for a variety of concerns such as maintenance, home design, and conduct. These payments are sometimes a pre-condition for new homeowners in certain regions.

- Prepaid interest: Prepaid interest is the amount of mortgage interest that accumulates between the closing date and the first monthly payment.

- Prepaid property taxes: A homebuyer pays two months of local property taxes in advance, usually known as prepaid property taxes, at the closing.

- Survey fee: The survey fee is the cost of professionally determining property boundaries (usually around $400), which is not usually a requirement for homeowners.

What aspects influence the calculation of home sale profits?

Sale price

The price your home sells for will have the biggest impact on how much money you receive after selling.

And the real estate agent you decide to sell with will play a big part in this.

The final price your home sells at will be the first number used to calculate your net proceeds.

Mortgage payoff amount

The payoff for your mortgage is handled by the escrow officer and includes the remaining balance and any miscellaneous fees the lender may charge.

The escrow officer will deduct this amount from your sale price when calculating your proceeds.

Real Estate Agent fees

Real estate commissions account for around 5 to 6 percent of the selling price of your property.

Your agent receives half of the commission, with the other half going to the buyer’s agent.

Data shows that the national average for commissions is approximately 5.8%, however, this will vary depending on where you reside.

For example, in certain cities like New York City, the real estate commission rate is 6%, but when the total home price exceeds $1 million, this rate rises to 6.5%

Real estate transfer tax

Transfer taxes are the taxes paid to local governments when the title of a home is transferred from the seller to the buyer.

These fees are paid to the county and city where the property resides, but not all counties and cities require them.

The amount of these transfer taxes is based on a percentage of the sale price.

You can check the percentage for your area, and then edit this field when using our house sale calculator to see how this will impact the net proceeds from your home sale.

Seller credit to buyer

Concessions are credited from the seller to the buyer, usually for closing costs.

This is more common when it’s a buyer’s market and almost always happens when negotiating with the buyer before their offer is accepted.

If this happens, you’ll see this on your closing statement as a debit from your proceeds that is being applied as a credit to the buyer.

Prorated property taxes

You don’t need to worry about how your property taxes get paid when selling.

Whether you pay this twice a year or have them included in your mortgage payment, the escrow company will ensure that the prorated amount is either credited or reduced from the amount you’ll make selling your home.

The prorated portion of your property taxes aren’t considered a “closing cost” per se, but it is a dollar amount that the escrow officer will need to calculate and take out of the profits from your home sale.

Capital gains tax

If you have claimed your home as your primary residence for two out of the last five years, then you should be exempt from having to pay a capital gains tax on all or part of your proceeds.

But you can expect to pay this if this is not the case, or if the profit from your home sale exceeds $250,000 (for single filers) or $500,000 (for married or joint filers).

If you do have to pay anything, you’ll do so when filing your taxes the following year.

You should seek advice from your tax person to get a better idea of how capital gains taxes can impact how much you’ll actually make selling your house.

Home warranty

A home warranty is a policy for the buyer that covers certain things in the home during the first year.

Some of these include appliances, heating/air conditioning, and more.

This is negotiable between you and the buyer. If you agree to pay for it, then you can add this to the cost of selling your house and as an additional item that will be deducted from your net proceeds.

Repairs and improvements

Your home doesn’t need to be in tip-top condition, but buyers do want a home without an extended list of needed repairs and improvements.

You can seek advice from your real estate agent to determine which ones are worth making.

You can also use our home value estimator to find the best upgrades for your exact home and see which ones will pay off.

Repairs and improvements are costs you’ll want to consider when calculating how much you’ll profit from selling your house.

Staging

Staging can help boost your selling price, which can maximize your profit.

The cost depends on your interior square footage and whether or not you’re living in your home while it’s listed.

The costs for full staging can range from about a thousand to several thousand dollars.

Some staging companies will require an upfront payment, while others will allow you to make payment through the proceeds of your home sale.

ON THE PREVIOUS POST: The Cheapest Way To Build Your HOME

Frequently Ask Questions:

Can you avoid capital gains tax by buying another house?

You can avoid a significant portion of capital gains taxes through the home sale exclusion, a large tax break that the IRS offers to people who sell their homes. People who own investment property can defer their capital gains by rolling the sale of one property into another

Do you subtract mortgage from capital gains?

The Internal Revenue Service doesn’t let you deduct mortgages or liens when figuring the tax on capital gains from property sales, even though you must pay them off in order to sell with clear title. … In fact, you probably won’t, thanks to IRS exclusions that apply to homeowners.

What will the capital gains rate be in 2022?

15% For single tax filers, you can benefit from the zero percent capital gains rate if you have an income below $41,675 in 2022. Most single people with investments will fall into the 15% capital gains rate, which applies to incomes between $41,675 and $459,750.