If you’re curious about how much your house is worth, you can estimate the value with a few simple steps.

The first step is to look up your house on a real estate website or in an online database.

This will give you an idea of what your house is worth on the current market.

The next step is to calculate the value of your house based on its size and condition.

You can use a house valuation calculator to help you with this step.

This will give you a rough estimate of what your house is worth.

Finally, you can adjust the value further based on closer look at the location.

If your house is in a desirable neighborhood, it will be worth more than if it’s in a less desirable area.

It’s important to remember that house values can change over time, so your estimate is only as good as the present time.

However, it can give you a good idea of what your house is worth.

If you’re thinking of selling your house, this information can be helpful in setting a price that will attract buyers.

How Much is my House Worth?

When getting a home value estimate, consider the three main types of valuation:

Fair Market Value

It encompasses what your home looks like to prospective buyers compared to other homes in the area.

Consider the sale price of a home that’s similar to yours (the same number of bedrooms and bathrooms, square footage, or outdoor space, say).

If you work with a real estate agent to help you sell your home, this is where your agent will start; by looking at comps (comparable) to gauge what buyers have been willing to pay for a property comparable to yours.

Appraised Value

While the appraised value of your home factors in comps, it differs from fair market value.

To calculate the appraised value, a licensed appraiser considers the location, size, and condition of your home, and any renovations you’ve completed from a professional standpoint.

The appraised value is what mortgage lenders look at when a borrower buys a home or refinances their mortgage.

Assessed Value

The assessed value is then assigned the dollar value of your home used by local county tax assessors to determine property taxes.

“Tax assessors calculate an assessed value based on various factors, which may include the appraised value and the fair market value, as well as any home improvements, whether you generate income from the property, and any tax exemptions,” explains Jade Duffy, a Realtor with TXR Homes based in Carlsbad, California.

Usually, the assessed value is lower than fair market value and doesn’t actually represent how much a property could sell for, Duffy says.

How Can You Find Out What Your Home is Worth?

1. Enter Your Address into a Home Value Estimator

There are several internet sites that provide a quick home value estimate.

These online tools, sometimes known as automated valuation models or AVMs, rely on algorithms and publicly available data, such as recent sales, tax assessments, and other public records, to produce an estimate.

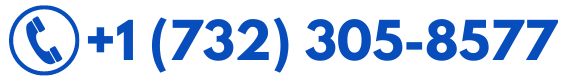

You may also receive a cash offer from STHomeBuyers.com if you need to offload a property very quickly.

The popularity of private real estate investors such as STHomeBuyers has risen dramatically during the last few years.

They can now be straightforward methods to get a fast estimate (or offer) with a simple call.

Take computer-generated house value estimates with a grain of salt.

They may occasionally be based on incomplete or incorrect data, and they may not take into account a recent high-end kitchen renovation or bathroom extension.

2. Request a Free Comparative Market Analysis from a Real Estate Professional.

In the hopes of obtaining your business, real estate agents often provide a comparative market analysis (CMA) for free.

The agent gathers data on recent comp or comparable sales in the neighborhood to complete the CMA.

They then utilize their knowledge of the area and any particular features of your property to estimate its worth.

This same service may also be provided by a buyer’s agent if you want to make an offer on any property.

Pros: It’s nice to have a professional examine comps, answer inquiries, and offer advice.

Cons: Agents may provide you with different comps or have differing views on the value of your property.

Furthermore, if there haven’t been many sales in the area or the comps aren’t that similar to yours, the estimate will be less precise.

3. Check The Website Of Your County Or Municipal Auditor For More Information.

For property tax purposes, county auditors periodically analyze the value of houses in the area.

This data is available online and may be searched by address.

You can check to see if your house’s assessed value has increased or compared it against comparable properties for sale.

Pros: The objective data is readily available and provides another perspective on the situation.

Cons: The house’s appraised value is usually higher than its market value (for example, if you bought it at a bargain).

This estimate is for the taxable value of your property and may not reflect some of the market variables that influence sales prices such as timing, competitiveness, or roof appeal.

In certain areas, assessed values are sometimes much different from market values; however, identifying them might take some time.

4. With The FHFA House Price Index Calculator, You Can Analyze Current Trends.

The Federal Housing Finance Agency’s House Price Index (HPI) calculator is another method to estimate house value.

The tool analyzes past mortgage data to forecast what homes in your state or metro area are likely to be worth based on the rate of growth in all houses within the region over a specific time period.

Pros: The calculator combines data from tens of millions of home sales to give comparative insights about long-term broad property price changes, allowing homeowners to assess the relative affordability of areas over time.

Cons: This calculator doesn’t estimate the market value of a particular house.

Instead, it offers a look at home price appreciation or depreciation over time.

While this will give you a general idea of the local market, it won’t drill down into the specifics of your property.

5. Hire a Professional Valuator for Help.

Before a loan is approved, mortgage lenders employ appraisers to verify the value of a property.

Some home sellers choose to go one step further by engaging an appraiser, but it is not necessary.

The appraiser considers the property’s features, such as the number of bedrooms and bathrooms it possesses, as well as comps, similar to a CMA prepared by a real estate agent.

Pros: When it comes to property evaluation, there are two primary varieties of experts.

Appraisers who specialize in a certain area or industry may be either general appraisers or specialists, depending on the state they work in.

General appraisers have no particular training and simply attend appraisal schools for a couple of weeks before beginning their careers as an expert.

On the other hand, specialists must complete several classes and pass examinations to get their license or certificate.

They can also offer objective evaluations of home values since they are licensed by the state they operate within and certified by their professional organization.

Cons: If you’re looking for a mortgage, you’ll have to pay for the appraisal that the lender requires.

An appraisal costs an average of $340, with fees ranging from about $300 to $420 based on HomeAdvisor.

My Property’s Value Increased… What Should I Do Now?

A variety of reasons may contribute to the increase in value of your house.

Currently, home values have risen in many areas owing to a lack of supply coupled with the lowest mortgage rates in history.

If the value of your property has grown, you have a few alternatives and considerations to consider:

You Could Save Money By Stopping Paying For Private Mortgage Insurance.

If you’re paying for private mortgage insurance (PMI) and your property’s value has risen to the point where you have at least 20% equity, you may ask your lender to terminate your PMI payments.

You Might Need To Make Changes To Your Homeowner’s Insurance Coverage.

The cost and coverage of your homeowner’s insurance policy are generally based on the value of your property.

If the value rises, you’ll want to be sure you’re adequately protected.

“It’s critical to have an annual conversation with your insurance agent about the value of your home to ensure that you’re fully covered,” Kimberly Smith, owner of Garnet Property Group in Bristol, Connecticut tells us.

You Could Be In A Better Position To Improve Your House.

You can use more equity in the property to take advantage of a home equity loan or cash-out refinance and invest in a renovation or remodeling project if you have more equity in the property.

“Determining a home’s value is useful if you’re thinking about taking out a home equity loan, home equity line of credit, or cash-out refinance so that you know how much stock you’ve built up,” Smith adds.

You Could Decide To Sell Your House.

If the value of your property has increased significantly, you may profit.

But before putting it on the market, carefully consider whether now is the appropriate time to relocate for you or your family, whether you’ll be able to locate a new home promptly, and how you’ll pay for it.

Best Online Tools To Help You Estimate Your Home’s Value

1. Zillow

Zillow is one of the most popular – and well-known – websites for keeping track of the value of your property.

One financial specialist, Joseph Carbone, stated that Zillow’s user interface was his favorite aspect.

You can get a Zestimate – a Zillow-made estimate of your property’s value – just by entering the value of your home into the user-friendly interface on the website. You may also use the website’s consumer-friendly features to locate houses in your area.

How to Find Your Home’s Value:

Type in your address and Zillow will immediately let you know if they have a Zestimate for your home.

You can also create an account, claim your home, and get regular updates on any changes in value.

2. Realtor.com

While Realtor.com might sound like a hub for real estate professionals, this website is free for anyone to use.

Just enter your address into the site’s homepage and you’ll learn an array of details including a price estimate of your home.

You’ll discover out about the local schools, median listing prices in the area, and even property tax assessments beyond a pricing estimate.

This tool can also be used to find out how much your neighbor is paying for their house.

How to Find Your Home’s Value:

Type in your address in the search bar, selecting “Home Value”, and you’ll get an immediate estimate, with the option to sign up for an account, claim your home, and get regular updates tracking its value.

3. RedFin

Redfin Estimate With Redfin, you can input a few details about any house and learn about the local neighborhood, property “walkability,” and how much yearly property taxes are.

How to Find Your Home’s Value:

Redfin gives you an immediate estimate of the value of your home just by entering your address into the search bar on the homepage and selecting “See Home Estimate”.

While calculating, they give you a breakdown of how they make their estimates.

4. Trulia

works similarly to Zillow. Once you reach the website, you can enter your address and learn how much your home might be worth. Instead of offering a Zestimate, however, Trulia offers the average listing price for similar homes in your area.

How to Find Your Home’s Value:

When you search your address on the home screen, you’ll be taken to a page with comprehensive information about your home and estate, as well as the option to get an estimate.

5. Real Estate ABC

You can now use the Real Estate ABC to get a Zestimate from Zillow.com, which is exactly what you’d get if you used it before.

I like this site because it provides a lot of recent home sale statistics for your area.

If a home is sold down the street, you’ll be able to discover how much the buyer paid for Real Estate ABC eventually.

Because recent sales are the most accurate indication of your property’s current value, this information may be very useful.

How to Find Your Home’s Value:

The site’s interface is simple and old-fashioned, but filling in the required data will provide you with your home’s value right now.

They don’t request any personal information, and for each address, they give up to 30 comps.

ON THE PREVIOUS POST: Selling Your Home For CASH

What Is The Most Accurate Online Home Value Estimator?

Zillow home value estimates are often considered the most accurate; however, this depends on the location and available data.

Known as ‘Zestimates,’ they have a national median error rate of 7.5 percent for off-market homes and 1.9 percent for listed homes.

Is Zestimate Close To Appraisal?

The Zestimate is not an appraisal and you won’t be able to use it in place of an appraisal, though you can certainly share it with real estate professionals. It is a computer-generated estimate of the worth of a house today, given the available data.

How Do I Find The Actual Value Of My Home?

The most accurate way to find the value of your home is to get a recent appraisal from a qualified real estate professional. However, there are other methods available online which can give you a ballpark figure. All of the sites mentioned in this article provide a free estimate of your home’s value.