If you’re planning to move but are worried about the amount of money that you will have to spend on repairs before selling your current home, we have a solution.

Regardless of the condition, we will give you a fair offer for your home.

So, you’ve just viewed a property and it appears to be the one. You’re ready to submit an offer now!

This is when your real estate agent generally steps in to write an offer letter on your behalf and send it to the seller’s agent.

It’s critical to have a good real estate agent on your side from the start of your house hunt since the offer letter might make or break your offer when it comes to getting the house you want.

However, competent agent will know their way around the entire process.

What is the rule of thumb for making an offer on a house?

The general rule of thumb is that you should offer at least 10% below the asking price.

However, this isn’t set in stone and you may be able to get away with offering less, depending on the market conditions and the seller’s motivation.

If you’re in a buyers’ market (i.e. there are more houses on the market than there are buyers), you may be able to get away with offering less than 10%.

On the other hand, if you’re in a sellers’ market (i.e. there are more buyers than there are houses on the market), you may need to offer closer to the asking price or even above it to stand out from the competition.

It’s important to work with a real estate agent who knows the market conditions and can help you determine what Offer is likely to be accepted.

When making an offer on a house, there are a few key things to keep in mind:

1. Your Offer should be based on your budget. It’s important not to Offer more than you can afford, as this could put you in a difficult financial position down the road.

2. Be prepared to offer a higher amount than your initial Offer. It’s common for sellers to come back with a counteroffer, so it’s important to have some wiggle room in your initial Offer.

3. Your Offer should be made in writing. This will ensure that there is no confusion about the terms of your Offer and will protect you in case there are any disputes later on.

4. Your Offer should include a loan contingency. This means that your Offer is contingent on you being able to secure financing for the purchase.

5. Your Offer should include a home inspection contingency. This means that you have the right to have a professional home inspector come and inspect the property before you finalize the purchase.

6. Your Offer should be made through a real estate agent. While you are not required to use an agent when making an offer, it is generally recommended as they will be familiar with the Offer process and can help you navigate any challenges that may arise.

7. If you’re ready to make an offer on a house, the first step is to find a real estate agent who can help you navigate the process. They will be able to provide you with guidance on what Offer to make and can submit your Offer on your behalf.

When making an offer on a house, it’s important to be aware of the potential risks involved. While there is always some risk associated with any property purchase.

there are a few things that you can do to minimize your risk when making an offer on a house:

1. Get a loan pre-approval before making your Offer. This will give you a better idea of how much you can afford to Offer and will show the seller that you are a serious buyer.

2. Get a home inspection before finalizing your purchase. This will ensure that there are no hidden surprises that could cost you money down the road.

3. Make sure your Offer is contingent on financing and a home inspection. This will protect you in case you are unable to obtain financing or if the home inspection reveals hidden problems.

4. Making an Offer on a house can be a daunting task, but working with a real estate agent can help make the process go smoothly. Keep in mind the tips above to minimize your risk and increase your chances of having your Offer accepted.

What’s the Process When Making an Offer?

The Offer Letter

Once you’ve decided on a property, you’ll likely need to provide the listing agent with a pre-approval letter from a lender.

This is so they know that you’re a serious buyer who will be able to finance the home.

Then, your agent will put together an offer letter that spells out the purchase price, earnest money deposit, any contingencies, and more.

The Offer Process

Once the offer letter is sent, the seller will either accept, reject, or make a counteroffer. If the seller accepts your initial offer, congratulations! The home is officially under contract. If the seller rejects your offer outright, don’t be discouraged. This is normal and just means that the seller isn’t interested in your offer.

It’s also common for the seller to come back with a counteroffer, which could include a higher purchase price, a smaller earnest money deposit, or different contingencies. If you receive a counteroffer, you’ll need to decide whether or not you’re willing to meet the seller’s terms.

Once you’ve come to an agreement with the seller, congrats! The home is officially under contract and you’ll move on to the next steps in the home-buying process.

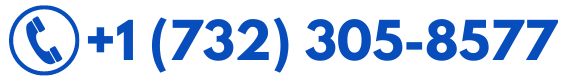

If you have any questions about making an offer on a house or would like help from a real estate agent, don’t hesitate to reach out.

What is Inside an Offer Letter?

An offer letter is what you’ll submit to the seller’s agent after you’ve decided on your purchase price. Offer letters usually contain the following:

- The purchase price offer

- Any conditions that must be met before the sale is final (i.e. inspections, repairs, etc.)

- The earliest date you’re available to close on the property

- How do you intend to finance the purchase

- Your real estate agent’s contact information

- A statement that says the offer is valid for a certain period of time (usually 24-48 hours)

- Once your offer letter is ready, your agent will submit it to the seller’s agent. The seller will then have the option to accept, reject or counter Offer your letter. If they accept, congrats—you’re one step closer to owning a new home!

- If the seller rejects your offer outright, don’t be discouraged. This is relatively common and simply means that the sell

IN THE PREVIOUS POST: Texas House Buyer

How do I put an offer on a house?

If you're interested in making an offer on a house, the first step is to speak with a real estate agent. They will help you determine what you can afford and assist with the offer process. Once you've decided on a property, your agent will put together an offer letter that spells out the purchase price, earnest money deposit, any contingencies, and more.

How much do you need to make an offer on a house?

This will depend on a few factors, such as the purchase price of the property, your down payment, and your financing. Be sure to speak with a real estate agent and lender to get an idea of how much you'll need to make an offer.

What do you say when making an offer on a house?

Your real estate agent will help you craft an offer letter that includes the purchase price, any contingencies, and more. Once the offer letter is sent, the seller will either accept, reject, or make a counteroffer. If you receive a counteroffer, you'll need to decide whether or not you're willing to meet the seller's terms.